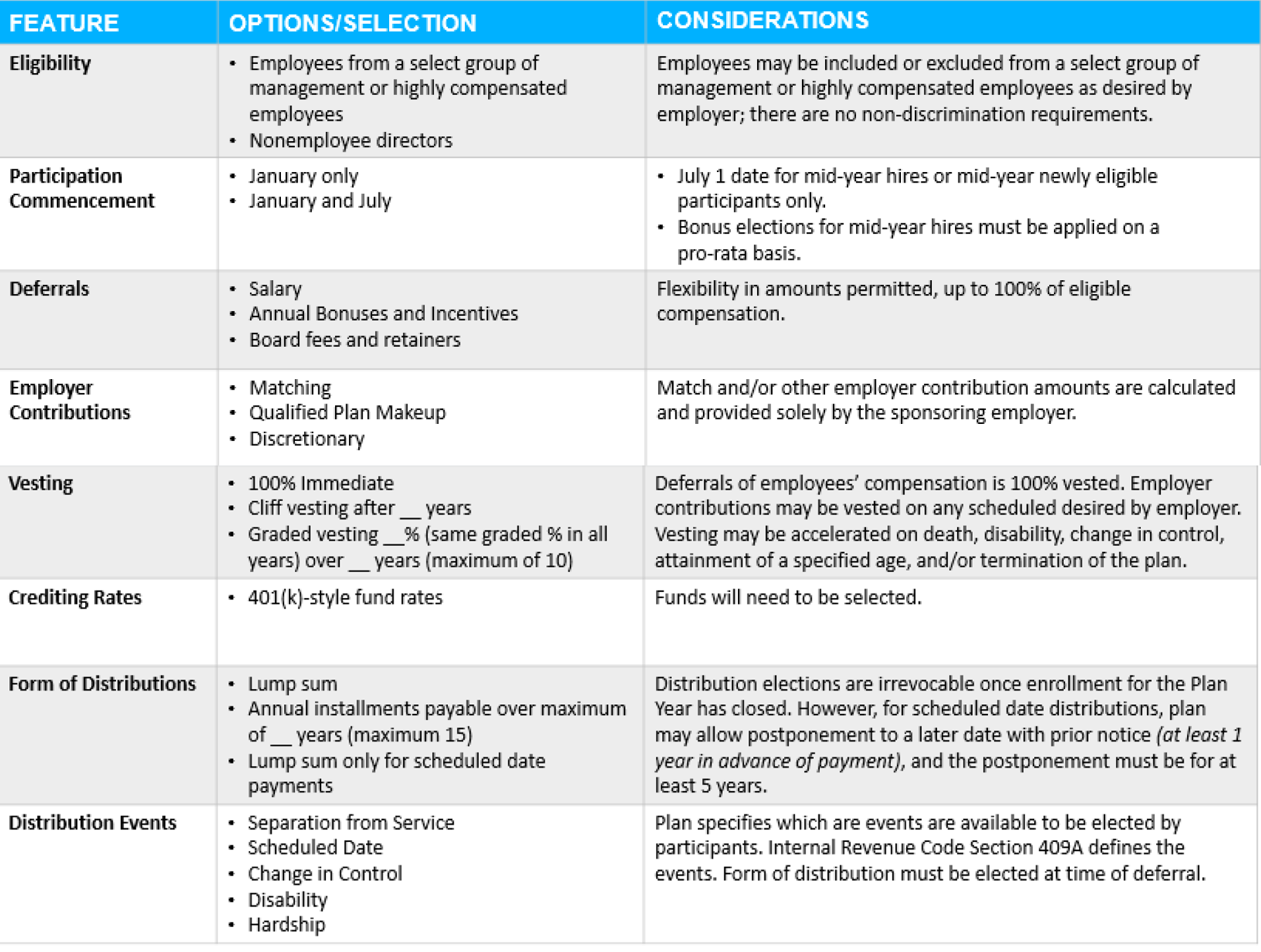

Qualified plans have contribution caps and other restrictions that limit pre-tax opportunities for highly compensated employees, generating a retirement income gap. Nonqualified Deferred Compensation (NQDC) is an important supplement to qualified plans, with flexible features that can be customized to be mutually advantageous for the employer and key talent. See the outline below of key elements included in a deferred compensation plan agreement.

Key Elements – NQDC Features