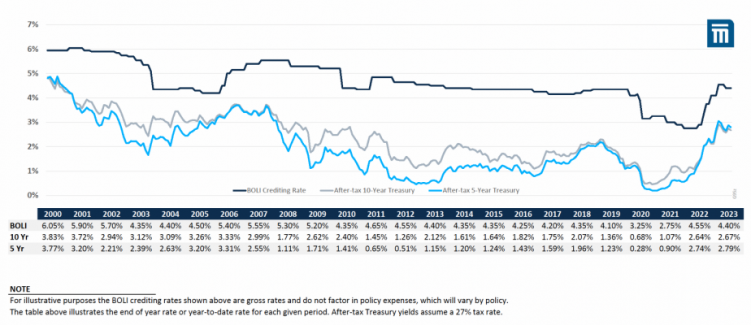

Although past performance is not indicative of future results, historically Bank Owned Life Insurance (BOLI) returns have always had a significant spread versus the after-tax returns of other bank permissible investments. Currently that spread is extremely wide (see chart below). The cost of waiting to invest increases every day a bank keeps funds in a low-to-no yielding taxable asset versus using those funds for a BOLI purchase.

The following graph illustrates the historical difference between after-tax ten-year and five-year Treasuries and a representative BOLI product.

Chart Source: Federal Reserve Economic Data | FRED | St. Louis Fed (stlouisfed.org)