Split Dollar Loan Regime Agreement & Contract

In a split dollar arrangement the employer is offering a loan to the employee which is utilized to pay the premium of a life insurance policy. The employee owns the life insurance contract, names a personal beneficiary and assigns the policy as collateral to the employer, in return for the employer’s premium payments.

The Split Dollar Agreement determines what occurs in the event of termination, retirement, vesting requirements and death benefits. Generally, at the employee’s death, the employer receives a portion of the death benefit (usually equal to the total premiums plus interest from the loan) and the employee’s beneficiary receives the balance.

In the event of termination or retirement the employer receives back the total premiums paid plus interest, up to the policy’s cash surrender value subject to the vesting schedule either immediately or at the employees death.

The most common approach is to have the loan interest rate determined by the long term Applicable Federal Rate (AFR). The employee pays the AFR either each year or accumulates the interest and repays the loan with interest from the death benefit.

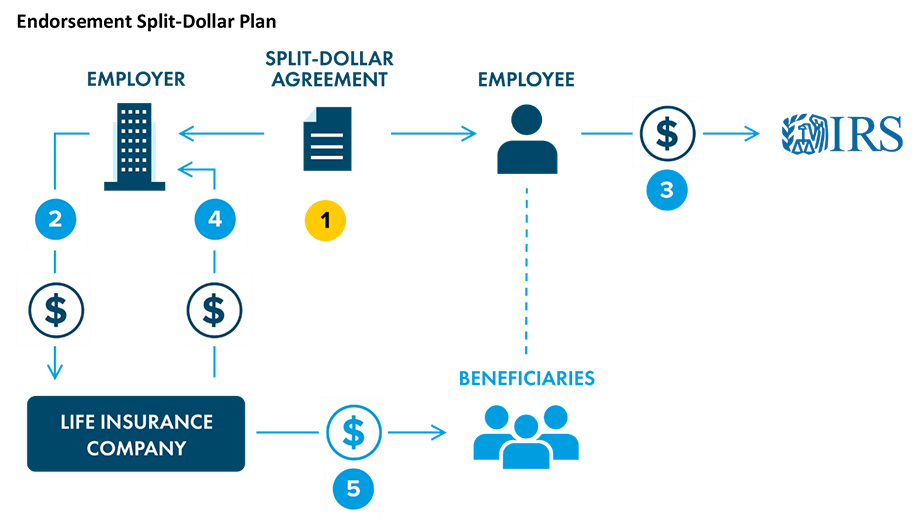

Diagram of Loan Regime Split Dollar

- The employer establishes a split-dollar agreement with the employee. The employer owns the policy and agrees to endorse a portion of the death benefit to the employee’s beneficiaries.

- The employer pays the premiums to the insurance company on the life of the employee.

- The employee is taxed on the value of the “economic benefit” of the policy, equal to the value of a term life policy with an equivalent death benefit.

If the employee dies:

- The employer receives the death benefit at least equal to the policy’s cash value.

- The employee’s beneficiaries receive the employee’s portion of the death benefit, federal income tax free.